When people think of bankruptcy they often think of it as being one thing, a bankruptcy. However there are actually six different “Chapters” in the bankruptcy code, four of which are available to individuals in the United States. The other two being for non-residents who want to file an international bankruptcy case or for a municipality that needs to reorganize.

The most common bankruptcy to file is Chapter 7. Chapter 7 is the liquidation form of bankruptcy. You are allowed to keep a certain amount of exempt property, the remainder of your assets are liquidated and dispersed to your creditors on a pro rata basis. Your unsecured creditors are generally discharged and your case is usually closed in four to five months. This can be limited by how much money you make per month. If you make too much money, you may not be able to file this chapter.

The next most common bankruptcy is Chapter 13. This is a reorganization bankruptcy where your debts are characterized and given priority based on those characterizations. Debtors in this kind of bankruptcy have to make payments toward their unsecured debts of their disposable monthly income for three to five years. There is a so called, “debt ceiling” to file this kind of bankruptcy, i.e. if you owe too very much money, you cannot file.

Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog

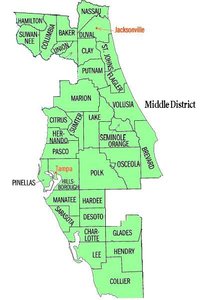

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the

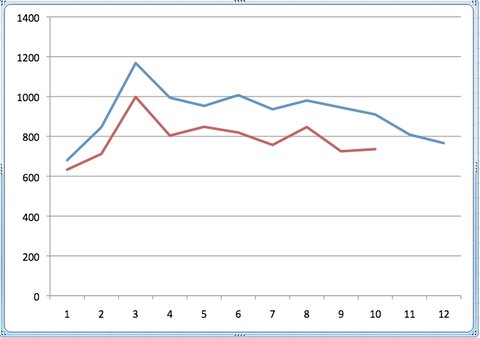

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the  Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.

Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.  Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays.

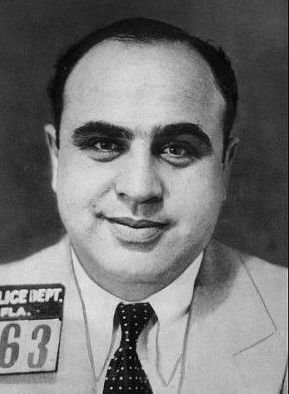

Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays. The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.

The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.