The Middle District of Florida has Divisional Locations in Jacksonville, Ocala, Orlando, Tampa, and Ft. Meyers. Bankruptcy filings within the Middle District of Florida have dropped 17.2% between January and June, 2011, compared with the same time frame in 2010. Although this seems to be good news for the economy, many people are still faced with outstanding debts that they just cannot handle. Filing for bankruptcy can get you a fresh, new start. If you would like to talk about your options, contact a Jacksonville Bankruptcy Attorney today for a free consultation.

Articles Posted in Chapter 13

Can I rent a home if I am in Banruptcy in Jacksonville?

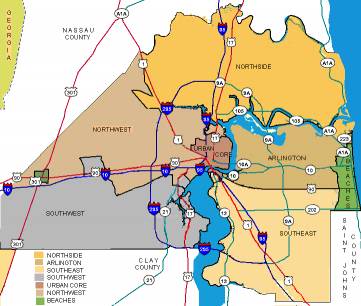

Many Jacksonville clients come to me with the same concern: “I need to get out of my upside-down home mortgage, but who will rent to us after we file for bankruptcy?” Having encountered this question so many times, and in the interest of trying to keep children in the same school district, I have created a list of apartments who are willing to rent to people who are either in bankruptcy or who have recently received a discharge. We provide this list to each of our Chapter 7 and 13 clients. It includes homes or apartments on the Northside, Westside, Southside, Mandarin, Orange Park, Arlington, Atlantic Beach, Neptune Beach and Jacksonville Beach. By no means are these all of the places a client could potentially live. Very few places said that a recent bankruptcy would be an outright bar to renting, though a few would require an increased security deposit.

My Home Has Been Foreclosed And There Is A Sale Date. What Can I Do?

Filing for bankruptcy will stop the future sale date of your home, even if there has been a final order foreclosing the property. This is due to an automatic stay that is immediately put into place upon filing for bankruptcy. Under the automatic stay, a creditor cannot take any action against you to try and collect a debt. So your foreclosure suit will halt immediately and your sale date will be cancelled; no more action will be taken in the case until the automatic stay is no longer in place.

The automatic stay will be effective until the conclusion of your bankruptcy. In a Chapter 7, this will probably be a short amount of time, around 4-6 months. But this extra time may give you the opportunity to catch up on your mortgage, achieve a modification, or sell your property. However, in a Chapter 13 bankruptcy, your case will not be concluded until after your Plan payments are finished. This will be anywhere from 3-5 years. Within those years, your Plan will allow you the opportunity to catch up on arrearages and so cure your deficiency with your mortgage company.

There are many ways in which a bankruptcy might be in your financial best interest. Help with mortgages that are in default is just one way a Jacksonville Bankruptcy Attorney can help you. Call us today at 904-685-1200 to schedule a free consultation.

Mortgage Help In Bankruptcy

Many people find that bankruptcy is the right option for them if they are having problems paying their mortgage. First, a Chapter 13 bankruptcy can give you time to catch up on the arrearages that you owe through a Chapter 13 Plan. Also, your Jacksonville Bankruptcy Attorney can file a motion within your bankruptcy requesting that your Judge order the mortgage company attend mediation, where your Jacksonville Bankruptcy Attorney can negotiate on your behalf to reach an amicable resolution. Finally, if you feel that you cannot or do want to catch up on your mortgage and are ready to walk away from your house, surrendering the property in your bankruptcy will shield you from any liability from a deficiency judgment.

If you are behind on your mortgage, contact a Jacksonville Bankruptcy Attorney today to discuss your options.

Private School Loans Dischargeable in Bankruptcy?

There is current legislation before both the US Senate and US House of Representatives that would allow private school loans to be discharged in bankruptcy, as most of them were before the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Legislators are reasoning that there is a strong interest in not allowing federally backed student loans to be discharged in bankruptcy, but these reasons do not apply to private school loans and so they are rethinking the laws. The New York Times wrote an interesting article on the topic.

To see if your loans qualify for discharge, contact a Jacksonville Bankruptcy Attorney today to discuss your situation.

How Long Will It Take Me to Pay Off My Debts With A Chapter 13 Bankruptcy?

When you file for Chapter 13 bankruptcy, you will pay off your debts through a Chapter 13 Plan that lasts anywhere from 3-5 years. A Chapter 13 Plan allows a debtor to catch up on most any debt, including mortgage arrearages, owed taxes, missed payments on vehicles, HOA dues, legal fees, fines owed to the city or state, and more.

Your unsecured creditors might also get some payments through the Chapter 13 Plan. If they will and how much will they receive is determined by your means test and the amount of unexempt property that you have. Any amount of unsecured debt that you have over this amount will be discharged at the successful conclusion of your Chapter 13 bankruptcy. For example, if you owe $20,000 in unsecured debt and your case only dictates that you must repay $5,000 to unsecured creditors, the $15,000 balance gets discharged or forgiven when you successfully complete your Chapter 13 Plan. If your case dictates that no money must be paid to unsecured creditors, then the entire balance of $20,000 would be forgiven.

To see how a Chapter 13 Plan would be structured for your specific situation, contact a Jacksonville Bankruptcy Attorney today for a free consultation.

Florida Case allows ex-spouse partial discharge of alimony obligation

In a Florida bankruptcy case stemming from a divorce, a husband’s lawyer argued that an alimony obligation was in part dischargeable by showing that it was not completely of a supportive nature. There are several kinds of alimony in the state of Florida, such as temporary, rehabilitative or lump sum. In this case, the alimony was labeled as rehabilitative. Rehabilitative alimony is usually intended to aid or help educate the person receiving it so they can increase their income to what it would have been had they not lost time and educational opportunities while helping their ex-spouse reach their career goals.

In general, alimony is considered to be for the support of another, making it non-dischargeable in bankruptcy under section 523(a)(5). As a result, family law attorneys will sometimes label what is actually a property settlement “alimony” so their client won’t have to worry about their ex-spouse discharging the debt. However, in the case of In re Harrell, the Judge found that an alimony award can be either supportive in nature or a property settlement and that it is the distinction between that those two that indicates the portion that can be discharged. In that case, only $500.00 of a monthly alimony obligation of $1,150.00 was found to be support and the remainder was discharged.

Many bankruptcy clients are mistakenly advised by their own family law attorneys who say that alimony is always a support obligation and that support obligations are non-dischargeable in bankruptcy. Although it is accurate to say that true “support obligations” are non-dischargeable, I would take a serious look at any alimony obligation before determining it to be untouchable in bankruptcy.

Continue reading →

My Mom Gives Me Money Every Month To Help Pay My Bills. Will I Have To Disclose This In My Bankruptcy?

Yes. You must disclose all sources of income on your bankruptcy schedules. You can, however, put on the schedules that this support is not likely to continue in the future, but you must disclose any monies received in the prior six months from any source. Some income, however, is exempt from counting towards your Current Monthly Income calculation as reported on the means test. Some social security income, unemployment income, pension income, etc. will not count towards your Current Monthly Income. Your Ponte Vedra Bankruptcy Attorney will know how to list your income so it will be most beneficial to you. Contact us today at 904-685-1200.

If I Have A Stable Job, Can I Still Be Eligible For A Chapter 7 Bankruptcy?

Whether or not you qualify for a Chapter 7 bankruptcy does not depend on what type of job you have, what your profession is, whether it is full-time or part-time, or whether it is seasonal employment or not. The question is not what type of job you have, but rather what your income is. To qualify for a Chapter 7 bankruptcy, your Jacksonville Bankruptcy Attorney will look at your income over the prior six months and compare it to the median income for your area. This is called the means test. If you pass the means test, your income is less than the median. If your income is over the median, then you still can qualify for a Chapter 13 bankruptcy. To see if you qualify for a Chapter 7 bankruptcy, call a Jacksonville Bankruptcy Attorney today at 904-685-1200.

Can I Get Rid of My Student Loan Debt in Bankruptcy?

The average student loan debt for a four-year degree is over twenty-three thousand dollars. Many people understandably want to get rid of this debt. However, student loan debt is very difficult to discharge in bankruptcy.

Generally, student loan debt is nondischargeable unless the debtor can prove he or she would suffer an “undue hardship”. Whether or not you are suffering an undue hardship is up for the court to decide, but it’s important to realize that this is a relatively high standard to show. Courts often look at whether you made a diligent effort to pay the debt, find a good paying job, and reduce your living expenses. In actual practice, almost the only way that you are going to get your student loans discharged through bankruptcy is if you are permanently disabled, with no opportunity or ability to get a job to repay your student loans.

If you are in debt and are thinking of filing bankruptcy, contact a Jacksonville Bankruptcy Attorney to discuss what debts can ben discharged and whether filing is right for you.

Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog