Recently, a small debate has been brewing in the legal world about whether a person facing foreclosure should file bankruptcy before or after their foreclosure comes to a close. First of all, bankruptcy is not always the best option for someone facing foreclosure.

If filing bankruptcy is right for you, some attorneys recommend filing after your home has been foreclosed on. This should allow you to discharge the debt and will help you move on with your life. But this may also limit your options.

It has been suggested that filing bankruptcy before foreclosure may give you the option to fight the foreclosure post bankruptcy. You would “Surrender” your interest in the property to the Trustee, which gives him the option to liquidate the property subject to the mortgage. However, because the mortgage is often higher than the house is worth, the Trustee disclaims any interest. It is then up to the bank to continue the foreclosure process either during or after the bankruptcy. While the bankruptcy goes on you may still be able to remain in your home (this may effect your bankruptcy exemptions). Theoretically, you will remain there essentially rent-free, as you will not be making your mortgage payments during this time. This could mean saving thousands of dollars in unpaid mortgage payments, depending on how long the bankruptcy takes. At the end of the bankruptcy you should have no unsecured debt and would have savings to use in negotiations with the bank. What’s even more interesting is that you would no longer be personally liability for the mortgage, so if negotiations failed, you could just walk away.

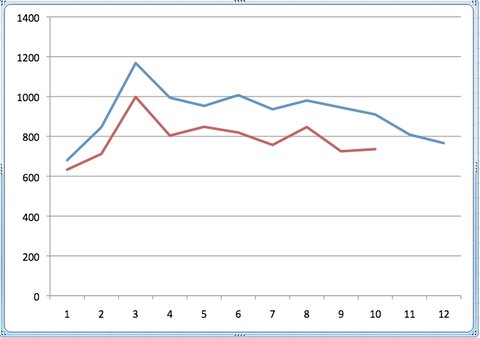

Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.

Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.  Jacksonville Bankruptcy Lawyer Blog

Jacksonville Bankruptcy Lawyer Blog

Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays.

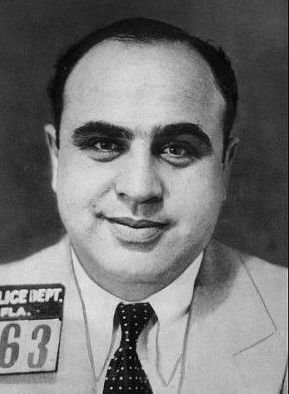

Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays. The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.

The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.  Your Jacksonville home has a sale date. You’ve been holding off on filing bankruptcy because you thought a mortgage modification might be possible and now you have 24 hours before your home is going to be sold. If you think that nothing can be done to stop it, you’re wrong.

Your Jacksonville home has a sale date. You’ve been holding off on filing bankruptcy because you thought a mortgage modification might be possible and now you have 24 hours before your home is going to be sold. If you think that nothing can be done to stop it, you’re wrong. As you may be aware, the L.A. Dogers filed for Chapter 11 bankruptcy protection in late June of this year. Chapter 11 is a reorganization bankruptcy available to both individuals and businesses where the creditors get to vote on whether or not to approve your proposed repayment plan.

As you may be aware, the L.A. Dogers filed for Chapter 11 bankruptcy protection in late June of this year. Chapter 11 is a reorganization bankruptcy available to both individuals and businesses where the creditors get to vote on whether or not to approve your proposed repayment plan.