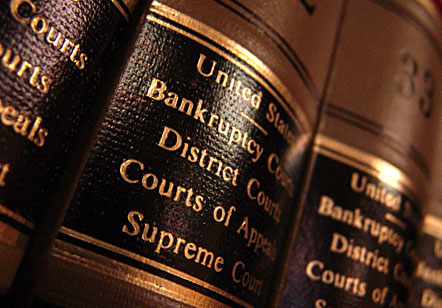

If you are behind on your mortgage payments, and think you can no longer afford your home or are simply ready to walk away and start over, a Short Sale might be a good option for you. A Short Sale is when you sell your home for the highest value possible notwithstanding that the proceeds from the sale will be less than your outstanding mortgage balance. The biggest short fall of a Short Sale is that you remain liable for the deficiency, which is the difference between the proceeds from the sale and your mortgage balance. However, in many Short Sale negotiations, this deficiency can be negotiated away. Thus, leaving you without any further liability for the home or mortgage.

The Short Sale Process is simple and is as follows:

– Begin the Short Sale process by hiring a realtor to list the property for sale as a Short Sale. Make sure the realtor you choose is familiar with the Short Sale process.

When a mortgage lender forecloses on a home, the total debt owed by the borrower to the lender often exceeds the foreclosure sale price. The difference between the sales price and the total debt of the borrower is called a deficiency.

When a mortgage lender forecloses on a home, the total debt owed by the borrower to the lender often exceeds the foreclosure sale price. The difference between the sales price and the total debt of the borrower is called a deficiency.