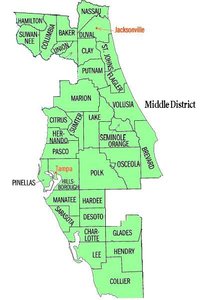

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the third highest rate in the nation from mid-2010 to mid-2011.

Florida was hit harder than most states when the recession of 2007 hit. The so named, “Middle District” being the third highest rate in the nation from mid-2010 to mid-2011.

As a result, it’s no surprise that Trailer Bridge, a local trucking and shipping company, filed for Chapter 11 bankruptcy reorganization yesterday. Truckers have been hit hard by the economic downturn and several of them are seeking loan modifications on their trucks. In a Chapter 13 reorganization, the secured amount owed on a truck can be reduced to what it’s fair market value is on the date of filing rather than what the driver actually owes in the contract. This method is called, “Redemption“. The loan new amount is also re-amortized to five years so that the driver leaves the bankruptcy owning the vehicle free and clear.

If you would like to learn more about “Redeeming” a vehicle, contact a Jacksonville Bankruptcy Attorney or call us at (904) 685-1200 to schedule a free initial consultation.

Doctors practicing in the Jacksonville area should consider their options in bankruptcy if they’ve been found liable for medical malpractice, especially if they were not covered by insurance.

Doctors practicing in the Jacksonville area should consider their options in bankruptcy if they’ve been found liable for medical malpractice, especially if they were not covered by insurance.  Ponte Vedra’s Sawgrass Marriott played host to this year’s Jacksonville Bankruptcy Bar Association (JBBA) seminar. The

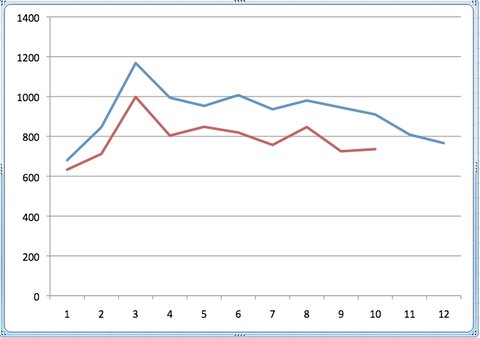

Ponte Vedra’s Sawgrass Marriott played host to this year’s Jacksonville Bankruptcy Bar Association (JBBA) seminar. The  Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.

Both Chapter 7 and Chapter 13 bankruptcy filings are down 16.35% when compared to the year to date filings from last year. These filings, which are traditionally down at the end of December and early January traditionally peak in the month of March. This is likely because people hold off filing their cases for those two months due to the holidays and come around to filing as soon as March hits and the financial strain of the holiday season is over. You can see the peaks on the above graph. Blue represents 2010, while red represents this year thus far.  Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays.

Jacksonville bankruptcy filings are always down from November through February and the reason is obvious: the holidays are upon us and no one wants to file bankruptcy during the holidays.