The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.

The Las Vegas Mobster Museum is headed to court, but not for racketeering. The museum that houses the world’s largest collection of organized crime artifacts (other than the FBI evidence room), has found itself faced with a Chapter 11 bankruptcy filing citing $5.8 million dollars in debt.

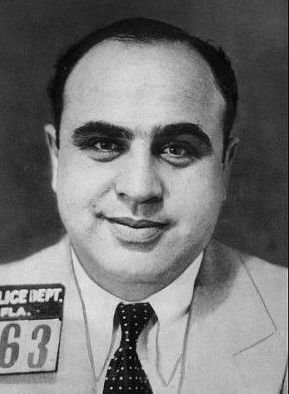

This museum’s debt is proportionally greater than the amount Capone owed to the IRS. When Capone was arrested in 1931 he owed $215,000 to the IRS. According to WestEgg.com this is the equivalent of about $3 million dollars today (after adjusting for inflation) and lead to Capone being given an eleven year prison sentence.

The Mobster Museum will be purchased for $2 million by JVLV Holdings LLC. The former developer, Jay Bloom, is faced with accusations stemming from overstated potential daily visitors and using corporate money to pay for personal automobiles, credit card bills and groceries. Depending on Mr. Blooms testimony, these transactions may be a violation of the bankruptcy code under 18 U.S.C. § 152. which protects against fraud in bankruptcy cases. Even if so, the maximum imprisonment under this statute is only five years, which is quite light when compared to Capone’s eleven. I guess this tells us something we already knew- that it’s bad to lie in bankruptcy court, but it’s far worse to lie to the IRS.

Jacksonville Bankruptcy judges are following Orlando judge’s lead in granting bankruptcy debtors motions for court ordered mediation. These motions not only require banks to attend mediation in good faith, but they also require the debtor and banks to come prepared -with all the information and documentation that is required to do a modification. Taking things further, the court will require the bank to send an agent who has actual authority to perform the modification.

Jacksonville Bankruptcy judges are following Orlando judge’s lead in granting bankruptcy debtors motions for court ordered mediation. These motions not only require banks to attend mediation in good faith, but they also require the debtor and banks to come prepared -with all the information and documentation that is required to do a modification. Taking things further, the court will require the bank to send an agent who has actual authority to perform the modification. Your Jacksonville home has a sale date. You’ve been holding off on filing bankruptcy because you thought a mortgage modification might be possible and now you have 24 hours before your home is going to be sold. If you think that nothing can be done to stop it, you’re wrong.

Your Jacksonville home has a sale date. You’ve been holding off on filing bankruptcy because you thought a mortgage modification might be possible and now you have 24 hours before your home is going to be sold. If you think that nothing can be done to stop it, you’re wrong. As you may be aware, the L.A. Dogers filed for Chapter 11 bankruptcy protection in late June of this year. Chapter 11 is a reorganization bankruptcy available to both individuals and businesses where the creditors get to vote on whether or not to approve your proposed repayment plan.

As you may be aware, the L.A. Dogers filed for Chapter 11 bankruptcy protection in late June of this year. Chapter 11 is a reorganization bankruptcy available to both individuals and businesses where the creditors get to vote on whether or not to approve your proposed repayment plan.  Sometimes debts that are supposed to be ‘dead and gone’ don’t stay buried. These debts are nicknamed, “Zombie Debts”. With the difficulties in the economy, debt collectors are being more creative with their collection attempts.

Sometimes debts that are supposed to be ‘dead and gone’ don’t stay buried. These debts are nicknamed, “Zombie Debts”. With the difficulties in the economy, debt collectors are being more creative with their collection attempts. With more than

With more than